Without drastic cuts in supply, the outlook for aluminum is bleak

by:Zeyi

2021-06-21

This is a bad year for base metals, and even before the outbreak of the coronavirus crisis, demand has slowed for 10 years. But aluminum is not the worst-performing base metal in 2020, and copper is well-deserved. However, this is only because aluminum has fallen less than copper, and demand has been sluggish before the coronavirus forced about 3 billion people to stay at home. Coupled with the almost complete closure of the global automotive and aviation industries, more than one-third of demand has been squeezed, and aluminum, a lightweight metal, is rapidly rising to the level during the global financial crisis. As the epidemic spreads, forcing producers such as Alcoa and BHP Billiton (Tinto, Rio de Janeiro) to make long-delayed decisions, this should translate into some of the largest production cuts in the mining industry. According to Bloomberg Information, aluminum is a continuously underperforming metal. Since 1913, the actual loss of aluminum has been the largest among all base metals. Over the past 10 years, demand has been slowing down, and even before the current epidemic crisis, it was predicted that there would be surplus by 2020. Aluminum prices have fallen below US$1,500 per ton for eight consecutive weeks, which has made most of the world's primary aluminum producers unprofitable. Aluminum has never been good at reacting quickly to changing markets, partly because of the low cost of raw materials for bauxite mining. At the same time, due to fixed costs such as electricity, smelters that use alumina to produce aluminum are slow and costly. Therefore, the industry is still using the inventory accumulated during the last crisis. It is against this background that it is not so surprising that China's aluminum production has increased in the first two months of this year. The scale and speed of the decline in demand caused by the coronavirus will test the industry’s resilience. Aircraft manufacturers are considering cutting production, and automakers from Japan to Germany have also stopped production. The premium paid by Japanese buyers to the London Metal Exchange is at its lowest level in more than three years. In a closed economy, car sales have fallen by about 80%. Other sources of demand, such as machinery, are not much better. Although consumers stock canned food, this only accounts for a small part of aluminum usage. BMO analysts estimated in late March that by 2020, global primary aluminum demand may fall by 6% from the same period last year-similar to 2008, but the absolute amount will be larger. This is not the most accurate estimate, but they said it has resulted in an unsustainable surplus of 4.2 million tons, which accounts for about 5% of global demand. During the global financial crisis in 2008, and a few years later in 2015, cheap Chinese metals flooded the market, causing aluminum giants to reduce production. By 2020, even if the Chinese government announces all the contents of the stimulus plan, China will not mitigate the impact to a large extent. A report by the Boston Consulting Group showed that in 2009, China’s overseas consumption fell by 17%, but domestic consumption increased by 15%. This time, even the Chinese people’s appetite may take several years to fully recover. There are some welcome signs of realism. Norwegian Hydro said last week that it will postpone the restart of the Haas plant's 95,000-ton capacity. CRU Group analysts estimate that China has cut its production capacity by about 400,000 tons. Even if the low-cost production of some Chinese aluminum companies is spared, more projects will be launched. Rusal United Company estimated in mid-March that about a quarter of China's smelters (equivalent to an annual production capacity of 10 million tons) are losing money when the price per ton is less than 13,000 yuan. At the same time, Rio Tinto is already reviewing its Tiwai Point smelter in New Zealand and ISAL aluminum smelter in Iceland, and now needs to seriously consider the funds allocated to its least profitable sector. All these cuts and more cuts are necessary, especially if weak demand continues. BMO predicts that by the third quarter, there will be 4.2 million tons of idle capacity each year, which will increase to 10 million tons by 2025. There are many unknowns from the duration of the economic downturn to the level of demand for traders seeking to bet on a stronger market in the future. For now, if the supply does not decrease significantly, it is difficult to see anything other than the bleak outlook. Reprinted from Ferreira Marcos

Zeyi Aluminum Co., Ltd. supports their market leadership with savvy marketing skills to create an prime brand.

At the heart of custom aluminium extrusion is our Vision to be the global energy company most admired for its people, partnership and performance.

Zeyi Aluminum Co., Ltd. deems that we can drive consumer transactions using high-tech tools like artificial intelligence and cognitive data sets.

But loyalty programs aren't just a boon for customers – Zeyi gets access to tons of valuable data for opt-in marketing campaigns.

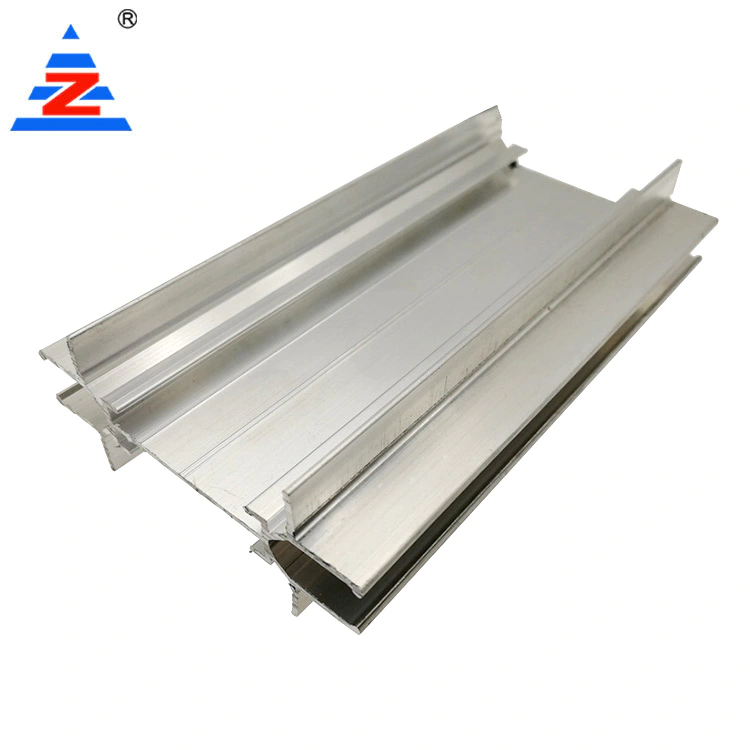

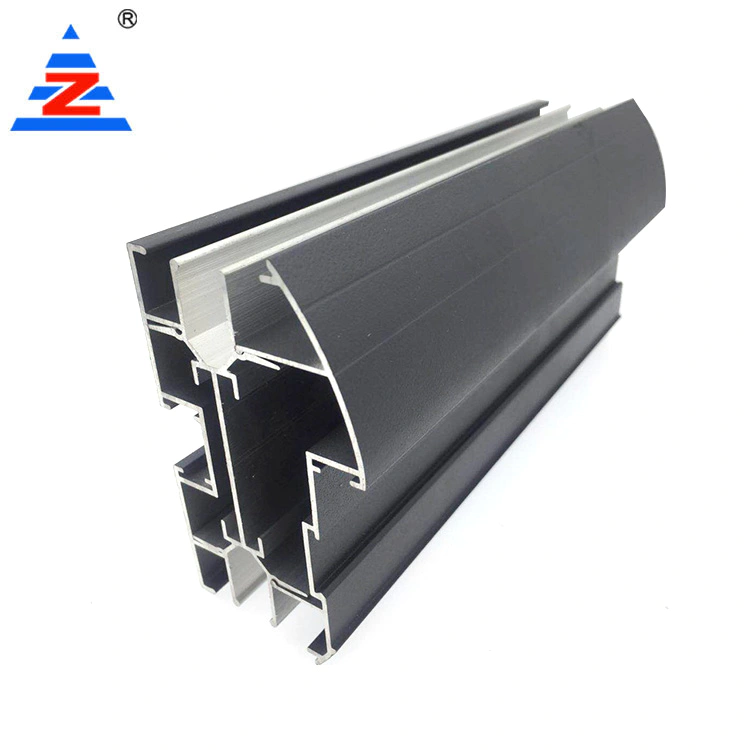

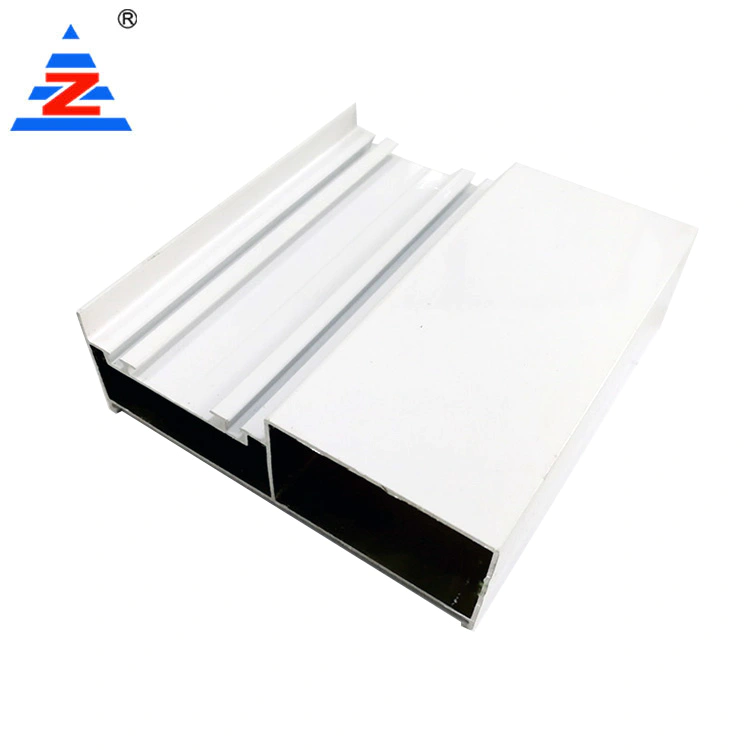

There are different types of , mainly aluminum extrusion rail and aluminum window profile manufacturers.

Zeyi Aluminum Co., Ltd. supports their market leadership with savvy marketing skills to create an prime brand.

At the heart of custom aluminium extrusion is our Vision to be the global energy company most admired for its people, partnership and performance.

Zeyi Aluminum Co., Ltd. deems that we can drive consumer transactions using high-tech tools like artificial intelligence and cognitive data sets.

But loyalty programs aren't just a boon for customers – Zeyi gets access to tons of valuable data for opt-in marketing campaigns.

There are different types of , mainly aluminum extrusion rail and aluminum window profile manufacturers.

Custom message